NEWS

● To make in-kind investment following the acquisition of 100% stake in SKC solmics in early December and maximize synergistic effects through concentration strategies

● To promote BM innovation in semiconductor materials and parts business with focus placed on the enhancement of CMP pad, blank mask, and cleaning business

SKC (CEO Lee Wan-jae) integrates its semiconductor materials and parts business into SKC solmics, a 100% subsidiary of SKC specializing in semiconductor equipment and parts. SKC, which has been promoting BM innovation in the semiconductor field, has decided to integrate its semiconductor materials and parts business into SKC solmics that will accelerate business growth in the sector by concentrating on the CMP pad, blank mask, and cleaning business.

At a BOD meeting held on the 23rd, SKC decided to invest in SKC solmics in-kind for its semiconductor materials and parts business, including CMP pads, blank masks, and wet chemicals, at the assessed value of KRW 151.3 billion. SKC is planning to complete necessary preliminary procedures such as a court approval decision and a business combination report by the first quarter of next year. Then SKC will receive 80.94 million new shares issued by SKC solmics and all the relevant procedures will be completed.

SKC made SKC solmics a 100% subsidiary in the second half of the year, laying the foundation for business growth in the relevant sector through integration: Following the resolution to integrate SKC solmics as a wholly owned subsidiary, SKC conducted a tender offer and comprehensive stock exchange for an external 42.3% stake. On December 8, SKC acquired all the relevant external shares to complete the internalization of the subsidiary.

SKC solmics has been showing a trend of improving earnings this year. By the end of the third quarter of this year, the company earned KRW 130.4 billion in sales, close to the previous year's annual sales of KRW 138.8 billion. Its operating profit of KRW 12 billion during the three quarters far exceeded the previous year's annual total of KRW 7.6 billion. Given the recent semiconductor big cycle, SKC solmics' annual earnings improvement is expected to increase significantly this year.

Following the integration, SKC solmics will continue to secure professional capabilities and expand its business as SKC’s subsidiary devoted to the semiconductor sector. SKC solmics, which has been focusing on semiconductor process components including silicon, quartz, alumina, and silicon carbide, has already begun expanding its business portfolio: In April, it declared its advance into semiconductor parts/equipment cleaning business and is getting ready to complete a cleaning plant in Wuxi, China and start business in the sector next year.

SKC solmics will maximize synergy and accelerate growth on the back of in-kind investment from SKC, which has focused on strengthening its semiconductor business since entering the CMP pad business in 2016. Last year, SKC started localizing high-end blank masks used for engraving electronic circuit patterns on semiconductor wafers. At the end of last year, it completed the construction of a production plant in Cheonan, Korea, for which it is now promoting the customer certification.

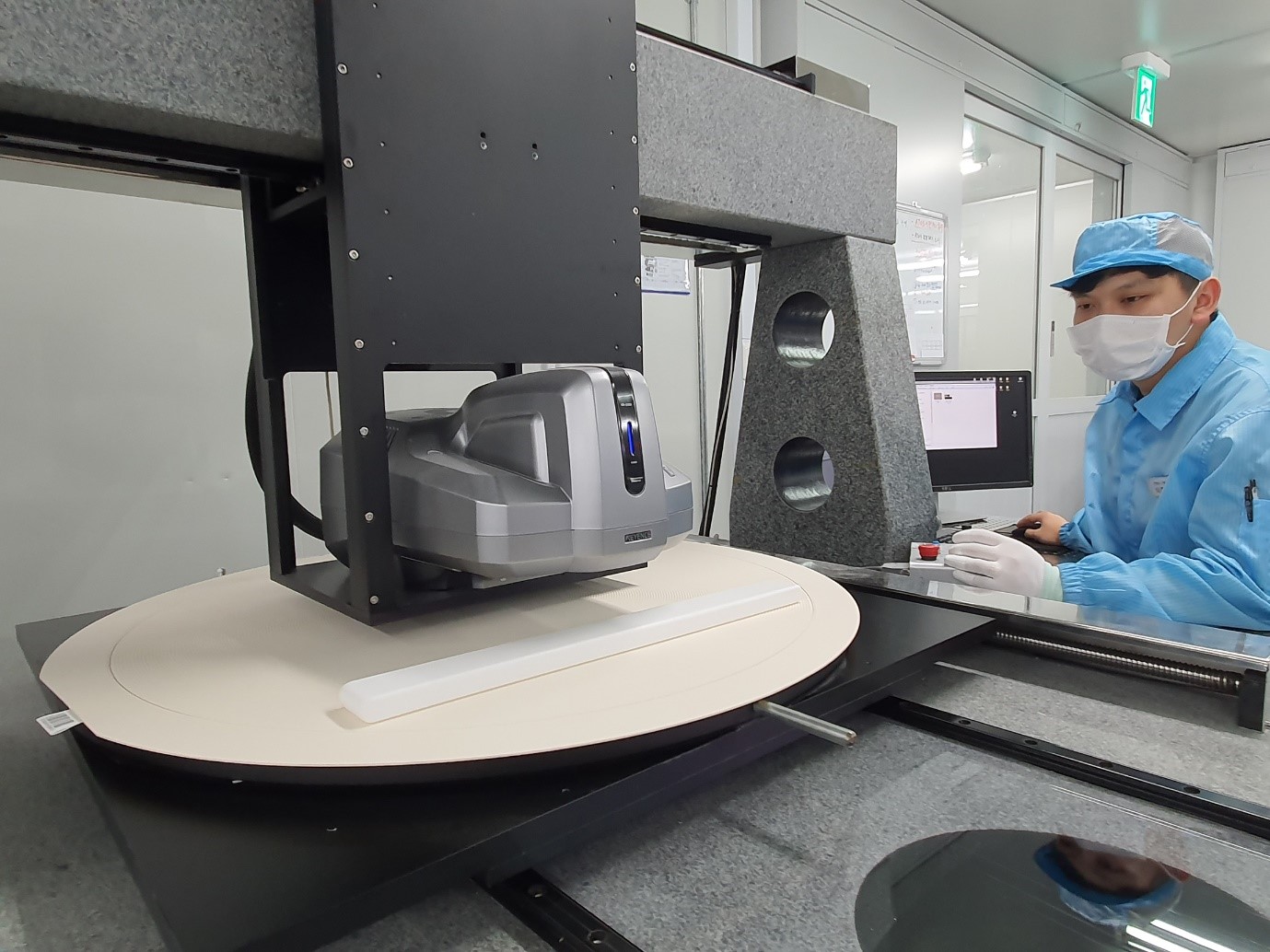

Next to the blank mask factory, SKC is building the second CMP pad factory for the semiconductor planarization process. The factory, with the production capacity twice as big as the first factory, will kick off production in the first half of next year. The company is also increasing its product range: Following the localization of products for the tungsten process in 2016, it succeeded in localizing products used for the kappa process last year and those used for the oxide process this year.

An SKC official said, "Once SKC solmics and SKC's semiconductor materials and parts businesses are integrated, synergistic effects will be maximized in the areas of new business ideas, marketing, and R&D," adding “SKC solmics will continue to grow as a specialized subsidiary in the semiconductor field by securing unrivaled capabilities in semiconductor materials and parts business with particular focus on the CMP pad, blank mask, and cleaning business.”

[SKC will integrate its semiconductor materials and parts business into SKC solmics which will accelerate corporate growth centering on the CMP pad, blank mask, and cleaning business. The picture shows an advanced CMP pad quality inspection process.]

[SKC will integrate its semiconductor materials and parts business into SKC solmics which will accelerate corporate growth centering on the CMP pad, blank mask, and cleaning business. The picture shows a high-end blank mask.]